- Card Scanning Cameras Walmart

- Card Scanning Cameras Amazon

- Card Scanning Cameras For Sale

- Card Scanning Cameras Wireless

So, you take last month’s credit card statement out of the envelope, look it over and realize something’s wrong.

Scan disk memory card. How do i get my pictures up when i insert my scandisk memory card from my camera. When i put it in my computer it comes up with autorun and nothing else and my photos do not show. Poker scanner camera, which we also call it playing cards scanner or marked cards reader, means that it can scan or read the code marked cards. With different forms and appearance, poker fans can choose the scanning camera as they like. Penpower WorldCard Color Portable Card Scanner, Black (SW-OCR-0012) 1. Free delivery eligible. How to Setup Quicklist Card Scanning Software. Once you've signed up for Pro Seller by TCGplayer, you'll be able to access Quicklist — our card scanning software designed to make inventory updates a breeze. Before we dive in, let's touch on requirements: Quicklist is PC exclusive software, so you'll need Windows 10 and a USB camera to get going.

You see a string of charges that you know for a fact you didn’t make. There are stores you don't recognize in places you haven't visited.

Did you just become the victim of a credit card scanner scam?

So the damage has been done, but it’s not irreversible. Most credit card companies are willing to strike the unauthorized charges from your bill and refund your money—as long as you notify them within 60 days of the issued statement. But the real question is: If the card is still in my fanny pack, how did it happen?

Criminals employ a number of nefarious ways to lift your credit card and banking information without getting 'go-go gadget arm' on your pockets (or fanny pack if that’s how you roll). Read below to find solutions to two forms of fraud that are widely talked about today—skimming and scanning.

How Does Credit Card Skimming Happen?

Skimming credit/debit card information at point-of-sale (POS) stations

While this scam has been around for several years, skimming is still a common method of credit card fraud. Skimming occurs at point of sale (POS) systems where debit and credit cards are used to make transactions, such as ATMs, gas pumps, and cash registers. More often than not, skimming is pulled off during legitimate transactions.

Card Scanning Cameras Walmart

One example of skimming occurs when thieves use a 'universal key' to open gas pumps and embed a device that captures card numbers. They also position a pinhole camera nearby that records the pin numbers. Fake cards are then encoded with the information and fiscal havoc ensues.

How do skim artists do this without getting caught? Sometimes it’s an inside job, orchestrated by an employee of the institution. Other times it is just good scouting; crooks pick stations that don’t have adequate camera surveillance. And any of those other instances in between, it’s the devil’s work. Seriously...

How Do Credit Cards Get Scanned?

Scanning radio frequency identification (RFID) chips on your credit/debit card

So what’s up with the microchip that’s implanted in all the credit/debit cards these days? Well, it’s actually a radio transmitter, and this type of technology has been around since WWII. RFID chip embedment is everywhere, from shoes (inventory management) to humans (for healthcare and security reasons).

Although banks claim that RFID chips on cards are encrypted to protect information, it's been proven that scanners—either homemade or easily bought—can swipe the cardholder’s name and number. (A cell-phone-sized RFID reader powered at 30 dBm (decibels per milliwatt) can pick up card information from 10 feet away.

And while there hasn’t yet been a recorded case of RFID fraud, many experts recognize that it would be difficult to track and that the verdict is still out as to how scanners will affect consumers in the future.

Tips to Protect Yourself From Credit and Debit Card Fraud

Skimming and scanning are totally avoidable fraud tactics. Keeping your guard up during transactions is a good place to start, but here are a couple more tips.

Preventing Credit Card Skimming

Skimming as a scam has endured for so long because it's so often successful. Try these tips for foiling card skimmers:

Don’t use free-standing POS terminals in badly lit or deserted areas. These are the most likely targets for skimmer action.

Deal directly with a teller or cashier when exchanging money. ATMs and other kiosks may be convenient, but you reduce your likelihood of being skimmed by avoiding them where possible.

Be on the lookout for damaged card readers. Any evidence of tampering should be seen as suggesting a fraudster may be at work.

Preventing Credit Card Scanning

Whereas avoiding skimming attacks requires increased vigilance during transactions, bolstering your defenses against scanning attacks can be achieved with some gadgetry and strategy.

Card Scanning Cameras Amazon

Buy a card sleeve or RFID wallet that blocks RFID transmissions

Stack your cards together to mitigate some of the scanner’s ability to read information

Leave your cards at home and only use cash in public places

While proactively outfoxing the fraudsters is an admirable plan of attack, it may not always keep you safe; crooks have a way of staying one step ahead of everyone. The best protection is being doggedly aware of your spending. This means religiously reading your credit card statements every month and keeping track of your receipts as points of reference. And as far as plastic goes, sometimes it’s just better to leave home without it.

When it comes to protecting against fraud and identity theft online, having an internet security solution with identity theft protection and secure browsing features can make the difference when it comes to online payments.

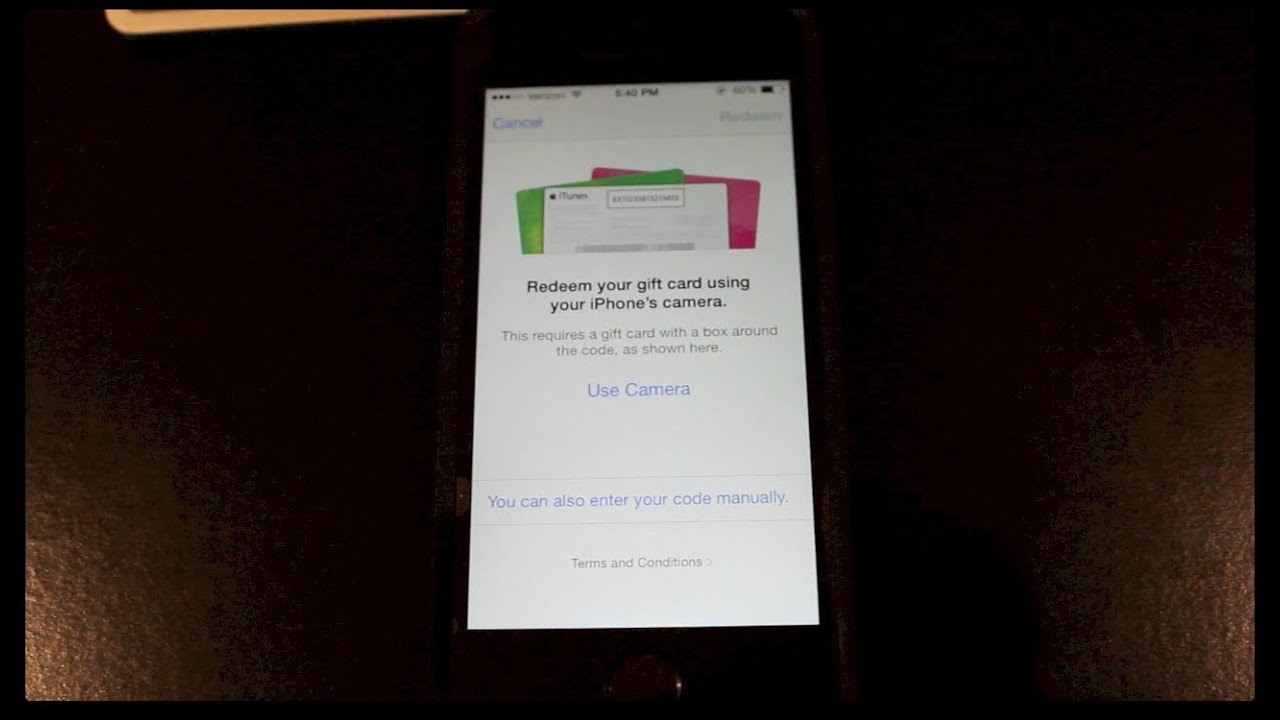

While accepting payment for your products or services is pretty much your most important business task, that doesn’t mean it should take the most time! You want the process to be as quick and professional as possible. So if typing in credit card numbers is taking up too much of your time, try using your phone’s camera to scan credit cards instead.

Card Scanning Cameras For Sale

Using your camera to capture credit card info is simple with the ChargeStripe app.

Here are step-by-step instructions:

1. Open the ChargeStripe app and enter an amount to charge. Press “Next” at the top right of the screen.

2. From the Payment screen, tap the camera icon.

3. Position your phone to get a picture of the credit card. The blue lines will come together to form a rectangle when the card is in position and ChargeStripe has captured the credit card information.

4. Enter the CVV number (for Visa and Mastercard, this is a 3 digit code usually found on the back of the card; for Amex, it’s 4 digits, usually found on the front of the card). Press “Done” at the top right of the screen.

5. Add an optional description or customer email to your transaction if you wish, and hit “Charge” at the top right of your screen.

Card Scanning Cameras Wireless

6. That’s it! You’ll see a “Payment successful” message appear. You’ve just charged your customer’s credit card using your smart phone’s camera.

Camera option not coming up for you? Here’s how to fix it.

If you don’t get the camera option, you probably just need to enable camera access in your phone’s settings.

1. Go to “Settings” on your phone.

2. Scroll down to find the ChargeStripe app, and tap it to see the details.

Do you do a high volume of sales with ChargeStripe? It might be worth investing in a credit card reader to make your transactions even faster. We sell card readers that work with iPhones and iPads, as well as Android devices.